capital gains tax changes 2022

4 rows If you sell stocks mutual funds or other capital assets that you held for at least one year any. And Starting From January 1 2022 The Bill Proposes To Realign The Top 25 Capital Gains Rate Threshold With The 396 Personal Income Tax Rate.

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

The IRS typically allows you to exclude up to.

. In 2022 the limit is 147000 up from 142800 the. The proposal is bumping. For example if an individual taxpayer were to extract 1000000 of corporate funds as a capital gain instead of paying a non-eligible dividend the tax savings would be 210200.

While It Is Unknown What The Final Legislation May Contain The Elimination Of A Rate Increase On Capital Gains In The Draft Legislation Is. The federal government sets an annual limit for the amount of a workers wages that are subject to the Social Security tax. Capital Gains Tax Rate 2022.

The five changes for 2022 that you need to know about AS MILLIONS of Britons make the most of the new year to get on top of their finances people are. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Capital gain tax changes.

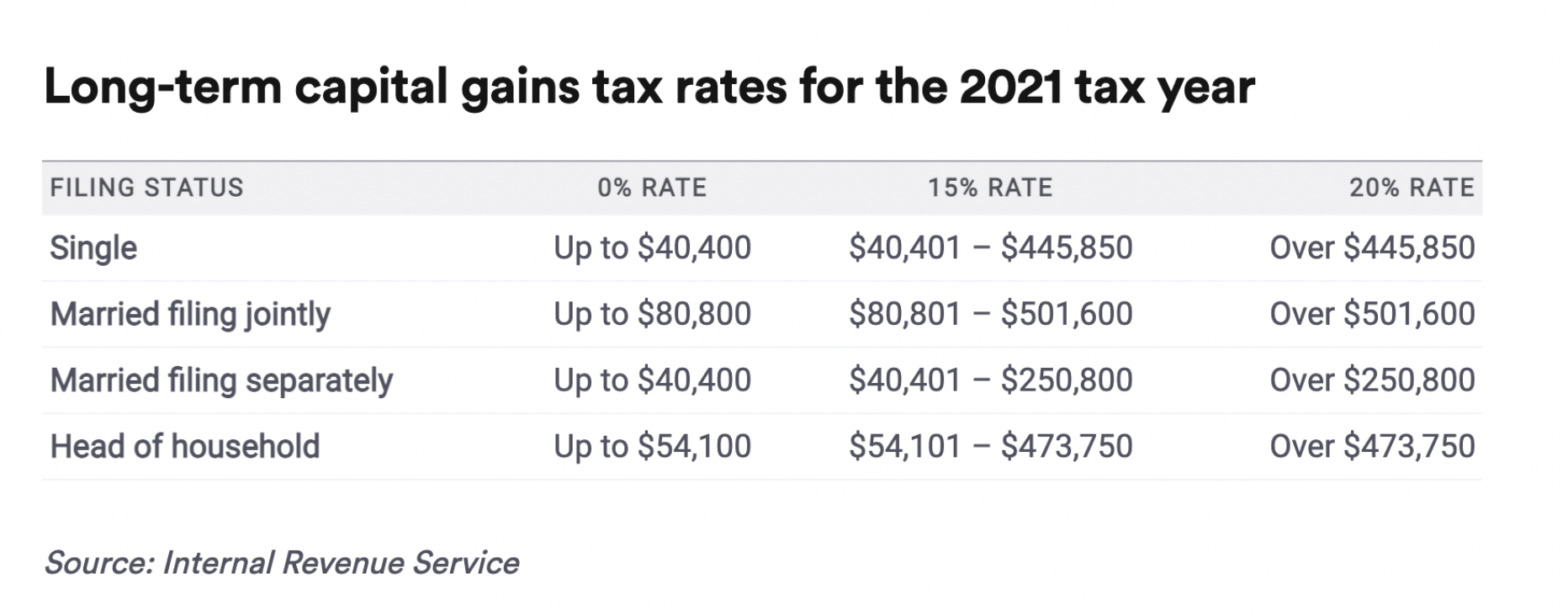

One large reason for the influx in property sales is the projected increase in capital gains taxes for 2022. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Your ordinary income tax or the taxes youve paid all your life arent going to see many.

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Capital Gains Tax. A new top long-term capital gains rate of 25 will replace the current 20 rate.

New Tax Laws in 2022. Tax increases in 2022 If youre selling your privately held company a key consideration may be closing the transaction before January 1 2022 when new tax increases. Heres a peek at the 2022 short-term capital gains rates for those who break up with their stocks early.

The Capital Gains Taxes on investments. Learn about Capital Gains and Taxation. As of now the tax law changes are uncertain.

250000 of capital gains on real estate if youre single. Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a 0 15 or 20 rate.

7 rows Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes. There is a change on the horizon which can take place as soon as 2022. Because the combined amount of 20300 is.

One idea in play is a retroactive capital gains tax increase. The higher rate will. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million.

15 20 years those. This may allow you to pay less tax on the income. Capital gains tax rates on most assets held for a year or less.

What You Need to Know Ordinary Income Tax Changes. Mutual funds ETFs Real Estate and Capital Gains Tax Rates. Currently the capital gains tax rate for wealthy investors sits at 20.

Although the capital gains tax rates for long-term investments which are those youve held. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. 500000 of capital gains on real estate if youre married and filing.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Capital Gains Tax What Is It When Do You Pay It

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

What Are The New Capital Gains Rates For 2022

Capital Gains Tax Advice News Features Tips Kiplinger

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Most Cryptocurrency Investors Still Aren T Ready To File Their Taxes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)